Financial AI Models for Real-Time Risk and Fraud Detection

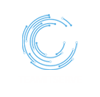

Imagine a world where a single suspicious wire transfer slips through unnoticed, costing millions—or where legitimate customers abandon their accounts because every purchase triggers a frustrating block. (Financial AI) In finance, trust is everything, and the margin for error is razor-thin.Billions of transactions flow daily, fraudsters innovate relentlessly, and regulators watch closely. Generic AI tools fight yesterday’s battles.Custom AI models—built on your institution’s unique data and realities—win tomorrow’s wars. As we step into 2026, leading banks and fintech are not just adopting AI; they are forging it into a precise, adaptive shield for risk and fraud. Here is how these tailored systems are redefining financial security and opportunity. Why Finance Demands Custom AI Financial data is unlike any other—dense with patterns, loaded with sensitivity, and shifting constantly as behaviours evolve and threats mutate. Off-the-shelf solutions rely on broad datasets and rigid rules, often missing the nuances of your customer base or regional quirks. Custom models dive deep into your proprietary history—every transaction, every flag, every outcome—learning the fingerprint of normal and the signature of danger. They adapt in weeks to new schemes.They slash false alarms without opening doors to risk.They stay fully compliant, with data locked tightly under your control. Revolutionizing Risk Assessment At the core of lending, investing, and underwriting lies one question: How much risk is acceptable? Traditional scoring models lean on static factors and outdated rules, missing the full picture. Custom machine learning systems ingest everything—transaction velocity, income fluctuations, repayment rhythms, even macroeconomic signals—and evolve predictions continuously. A mid-tier lender we know replaced legacy scoring with a bespoke model.Credit decisions sped up 40%.Default rates fell 18%.Previously overlooked segments gained access to fair loans. The edge? Precision that balances growth with safety, turning risk management into a competitive advantage. Elevating Fraud Detection to an Art Fraud never sleeps.Criminals test limits with synthetic identities, account takeovers, and lightning-fast mules. Rule-based systems drown investigators in alerts—90% often false. Custom AI watches behaviour holistically: how a customer types, shops at 2 a.m., or suddenly wires abroad from a new device. One regional bank deployed such a system trained solely on their transaction flows. False positives plunged 45–50%.Sophisticated rings—previously invisible—were caught early.Manual review teams shrank, costs dropped, and customers stopped raging about blocked cards. The system recouped its cost in eight months through recovered losses alone. Striking the Delicate Balance: Security Without Friction Nothing erodes loyalty faster than rejecting a legitimate vacation spend. Custom models learn individual baselines— “This customer always books flights last-minute”—allowing bold blocks only where truly warranted. Security strengthens.Customer satisfaction rises.Churn decreases. Compliance Built In, Not Bolted On Regulators demand explainability, fairness, and ironclad privacy. Custom deployments keep data sovereign, logs auditable, decisions traceable. No mysterious vendor black boxes.Full alignment with evolving standards worldwide. Confidence for boards, examiners, and clients alike. The Horizon Ahead Looking into 2026 and beyond, financial AI will shift from reactive defense to proactive intelligence—predicting vulnerabilities, simulating attacks, even shaping customer habits toward safer behaviors. Institutions investing in custom models now are not just protecting assets.They are unlocking growth through sharper decisions and deeper trust. Your Institution’s Next Step Generic tools keep you in the pack.Custom AI puts you ahead—resilient, agile, unmistakably yours. Because in finance, one size never fits all.Your AI should not either.

Financial AI Models for Real-Time Risk and Fraud Detection Read More »